Article

Blockchain: What is it and how has it evolved? #10YearsChallenge

Decentralization is one of the aims of blockchain solutions in order to avoid relying on trustworthy third parties to record system user transactions

This past October marked the tenth anniversary of the white paper released by Satoshi Nakamoto, the pseudonym of the person who wrote the document on Bitcoin, an online peer-to-peer electronic cash system.

In addition to the cryptographic principles on which his solution was based, such as digital signatures, he also used Haber and Stornetta’s timestamping schemes, whose idea of linking encrypted messages inspired the name of the Blockchain solution.

Since it was first published, the term now encompasses an entire ecosystem that includes new protocols and distributed ledger technologies (DLT); projects in which they are applied; communities of individuals and consortia of companies that adopt, support and fund them; and regulators who attempt to classify these continuously evolving new activities.

Let’s analyze some of the keys that have led to its fast growth.

Decentralization is one of the aims of blockchain solutions in order to avoid relying on trustworthy third parties to record system user transactions. This enables anyone to participate, under the same conditions, in registering the activity as agreed upon by consensus.

To achieve this, three layers are established:

A consensus layer, where participants’ trust is established in the system through a distributed consensus protocol (Proof of Work in Bitcoin). It is akin to a public examination process in the sense that it encourages participating nodes to allocate processing and storage resources in exchange for electronic cash (in theory, the more time and effort spent on studying, the greater the chance of becoming a civil servant).

The network layer, consisting of a P2P network with nodes that execute a public, open-source algorithm that validates and sends functional transactions, grouping them into a block of a specific size. This block is associated with a cryptographic challenge (a test akin to the public examination process). The solution, which is “arbitrated” by the consensus protocol, results in a cryptocurrency reward for the winning node. The block then becomes an unchangeable part of the final chain stored in each of the nodes.

An application layer, which is implemented in the algorithm along with the consensus protocol to establish the system functionality and register irrefutable proof in the chain of who owns what, and what has been spent and received.

The initial success among Bitcoin’s early adopters was primarily due to the cryptocurrency rewards they received in exchange for supporting the system (mining). New projects were soon launched that made the protocol more efficient and associated their own cryptocurrency (altcoins).

The next step was to directly develop new payment systems, such as Ripple (2012). Based on an alternative DLT and backed by a corporate community, it is currently used by several banks and payment networks as the technological infrastructure for transfers. Another example is Nxt (2013), which was the first blockchain system to implement a Proof of Stake consensus protocol using an ICO for the initial distribution of its cryptocurrency.

Continuing our focus on finance systems, in 2015, the tech company R3 launched Corda, its private blockchain platform, leading an initial consortium of financial institutions.

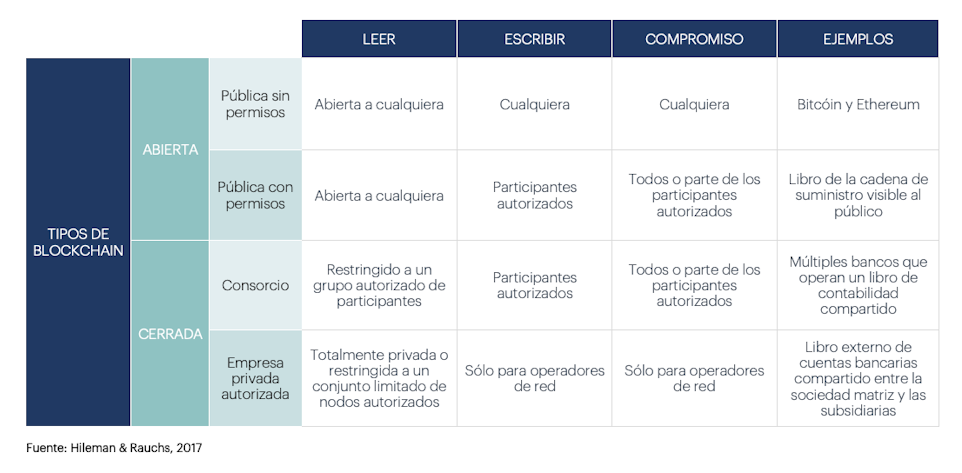

Therefore, depending on the type of access established by the communities of these systems, blockchain solutions can be classified as public, when they are open and anyone can read and view transactions, such as Bitcoin; and private, if they can only be accessed by a specific group of previously agreed upon participants. They can also be divided into systems with permissions, where only a select group of participants are authorized to create transfers and verify new blocks to be added to the chain; and without permissions, where anyone may contribute and add data freely.

Up until now, initiatives have focused on evolving the consensus and network layers for the financial sector. However, it was primarily in 2015, after the emergence of Ethereum (public) and Hyperledger (private), when blockchain systems sought to expand their application layer and find new use cases for all types of industries: commerce, supply chain, logistics, customer loyalty, insurance, energy, health, education, public services, identity, etc.

Through the development of Dapps and smart contracts, proofs of concept and pilots were launched to show the operating efficiency and new business models that were possible.

Today, apart from the volatile cryptocurrency market and a regulatory framework that is under construction, blockchain systems are finding their place in corporations backed by key players in the financial technology industry of business software, and separate from systems integration consulting firms and academic institutions.

The next few years will be a great opportunity to launch, alongside other digital transformation levers (5G, IoT, AI, cloud and cybersecurity), new Internet models such as those for smart cities, mobility and industry 4.0.

José Alberto Pérez

jose.alberto.perez@nae.es